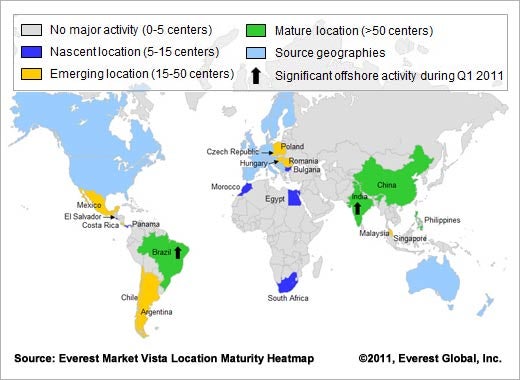

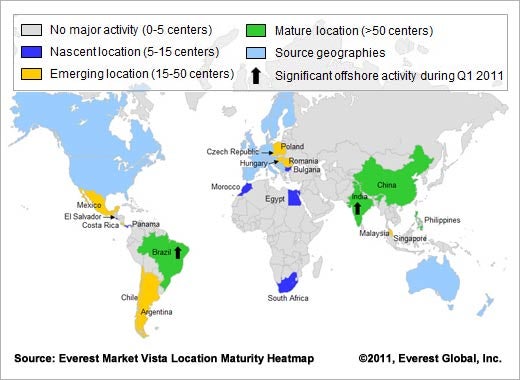

Based on recent research from the Everest Group, the offshore services market witnessed 35 new delivery centers set up across captives and service providers during Q1 2011. Although this is lower than the 46 centers set up in Q4 2010, most of the decline can be attributed to the impact of seasonality with the first quarter typically reporting a lower market. The Everest Group expects location activity to increase during the latter part of this year.

Activity did increase in Latin America with the number of new centers reaching a 12-month high, and Brazil being reclassified as a “mature location” on the Everest Market Vista Location Maturity Heatmap.

Click through for Q1 2011 outsourcing trends identified by the Everest Group.

The Market Activity Heatmap witnessed a major change in categorization of countries in terms of their maturity for supporting global services. Brazil was elevated to the category of “mature location” during Q1 2011, an elite group previously consisting of India, the Philippines, and China. Market activity was high in India and Brazil with both captives and third-party service providers setting up multiple delivery centers in these locations.

Asia continued to account for the majority of activity, with 20 new centers reported in Q1.

Within Asia, India dominated with 11 new delivery centers being set up during the quarter, while activity was also reported from China.

Activity in Latin America increased with 10 new centers reported during Q1. Brazil dominated activity with four new centers, while two centers were set up in both Colombia and Costa Rica.

Brazil’s reclassification as a “mature location” is a testimony to the maturity of the global services market in the country for IT services. In addition, service providers and captives also recognize an opportunity in leveraging Brazil for engineering services and R&D.

Overall, location activity in Eastern Europe continued to remain low but showed improvement on the back of economic recovery in Continental Europe.

Despite the crisis in the Middle East and North Africa, service providers continued to demonstrate their faith in Africa and reported three new delivery centers in the first quarter.

In contrast to Q1 2010, Q1 2011 saw a much higher share of Tier-2 cities as compared to Tier-1 cities.

The higher share of Tier-2 cities is largely attributed to existing service providers, who having established their delivery footprint in Tier-1 cities, actively explored Tier-2 cities given lower costs of delivery and access to a sizeable talent pool.

The political crisis in the Middle East and Africa during the beginning of the year continues to have an adverse impact on delivery of offshore services from the region. During the violence and subsequent curfew in Egypt and Tunisia, some companies shut their centers completely while others shifted work to other centers in their global portfolio.

Service providers are beginning to expand into Tier-3 cities in India, beyond Tier-1 and Tier-2 locations. Although Tier-3 locations provide benefits of lower operating cost (30-40% cheaper than Tier-1 cities) and access to a fairly sizeable labor pool, there are challenges for leveraging these locations for offshore delivery of services. These include availability of fewer options of quality infrastructure and a relatively nascent business environment in these locations. Consequently, service providers are leveraging these locations for serving the Indian domestic market.

Uruguay is beginning to emerge as a credible location for multilingual operations in Latin America. Key advantages include access to a rich multilingual pool besides English (e.g., Spanish, Portuguese, Italian and French), as well as stable geopolitical environment with advanced infrastructure support for businesses.