But historically there has always been a line between software and hardware that most vendors didn’t try to cross. But now that Oracle has decided to pull support for the Intel Itanium processor, the prevailing thought among customers seems to be that this move is a precursor to a broader effort to persuade or force customers to replace Itanium systems with systems based on Sun Sparc processors.

But a survey of 450 IT decision-makers conducted by the Gabriel Consulting Group finds that Oracle customers don’t find that idea especially appealing. In fact, a major portion of them are so bothered by the idea that they are not only looking to replace Itanium system hardware, they are giving serious thought to also replacing Oracle databases and applications software.

Dan Olds, a principal with Gabriel Consulting, says that Oracle’s efforts to redeem its acquisition of Sun by trying to get customers to embrace Oracle software one way or another on Sun Sparc hardware could easily backfire. If anything, says Olds, it seems to be creating a significant opportunity for Oracle competitors such as IBM and SAP.

There’s no doubt that Oracle sees a new age of combined hardware and software offerings that it says will lower the cost of enterprise IT by eliminating many integration headaches. But there is an old saying that it’s always best to marry your software vendor, but only date your hardware vendor. As Oracle’s overall strategy continues to evolve, it will be interesting to see if it can actually change the prevailing culture when it comes to the separation of hardware and software by marketing the value of a turnkey approach, or whether the company will have to resort to more hardball tactics to get what it wants.

Click through for results of a survey conducted by Gabriel Consulting Group on the current state of Oracle.

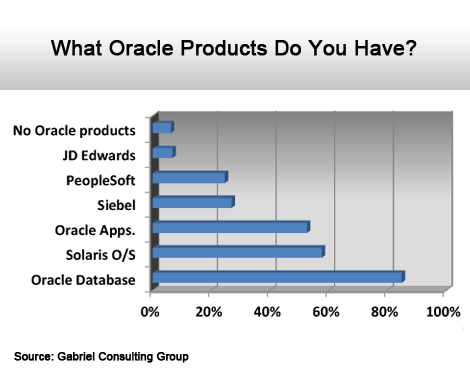

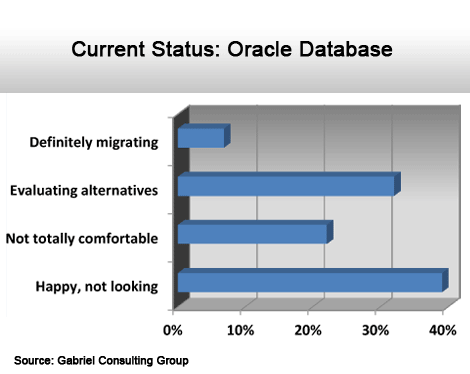

The majority have an Oracle database installed.

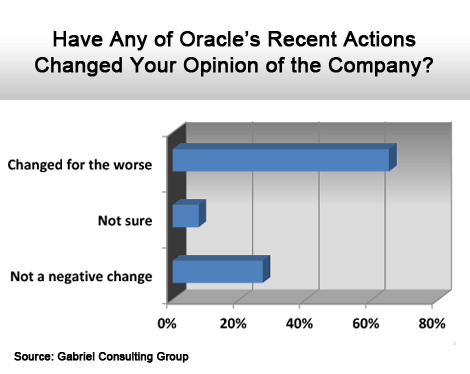

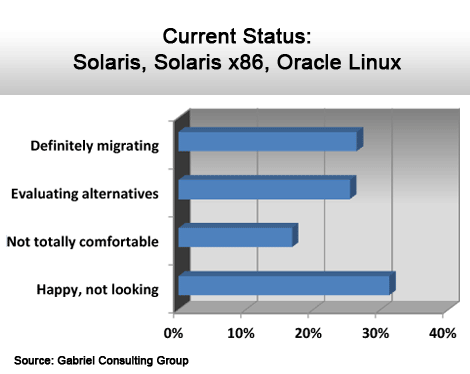

More negative than positive.

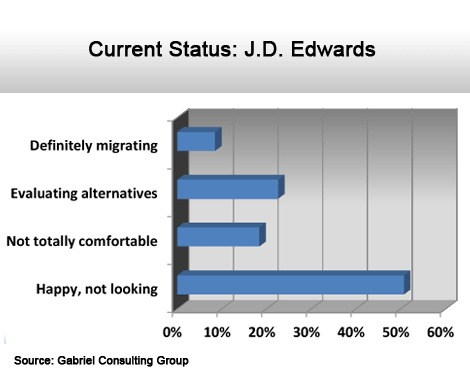

The most happy in the survey.

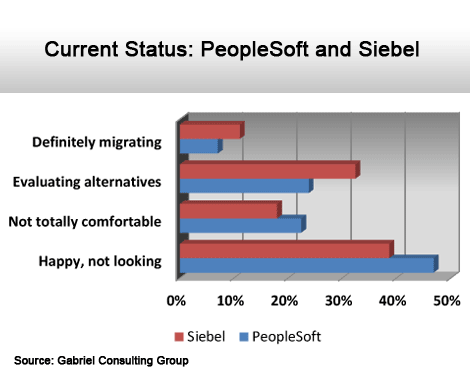

More actively evaluating alternatives.

More than a third are evaluating or looking to make a move.

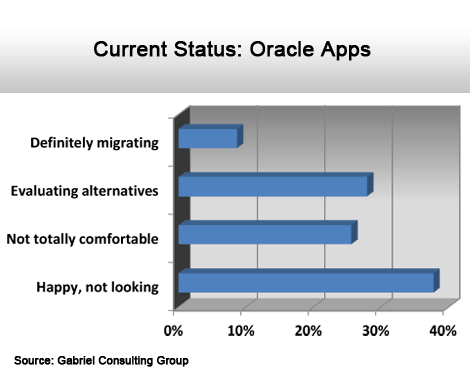

A surprisingly high percentage on Oracle’s core product line.

Definitely bleeding.

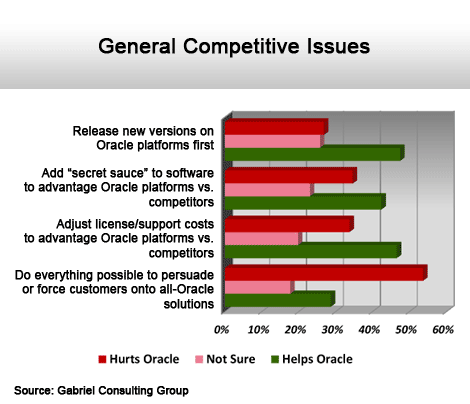

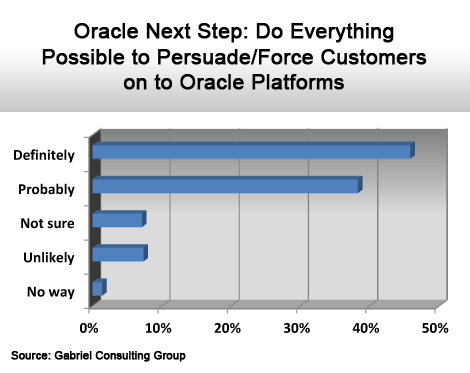

Most respondents are okay with Oracle strategy except when it comes to forcing a platform choice.

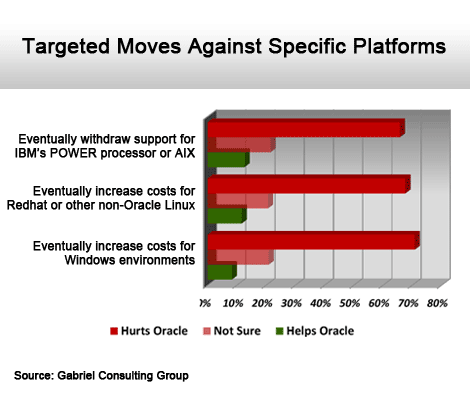

Not in the customer’s interests.

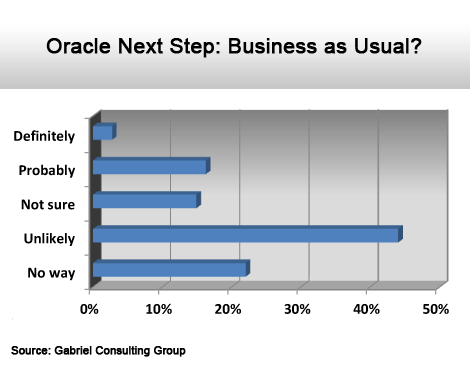

Most don’t think so.

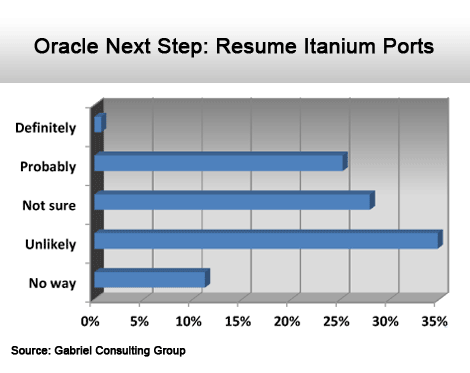

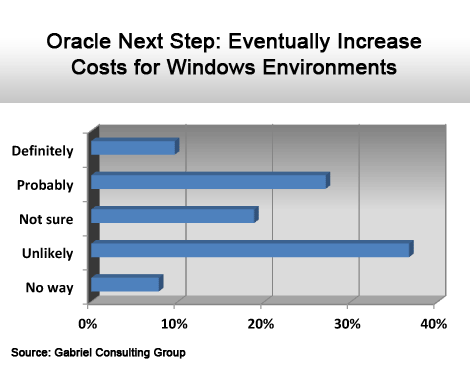

Not likely.

Viewpoints are divided.

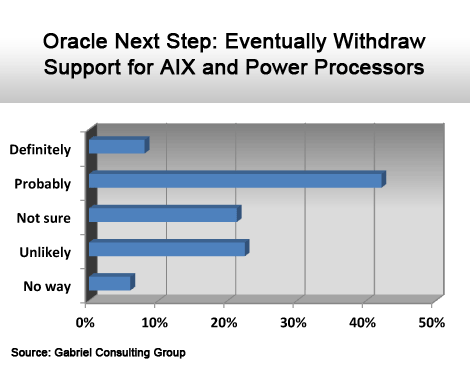

A high probability.

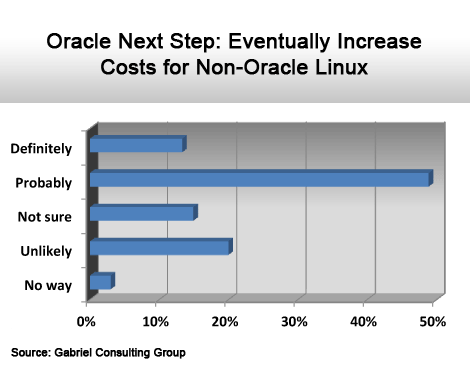

Also expected.

A heavy hand.