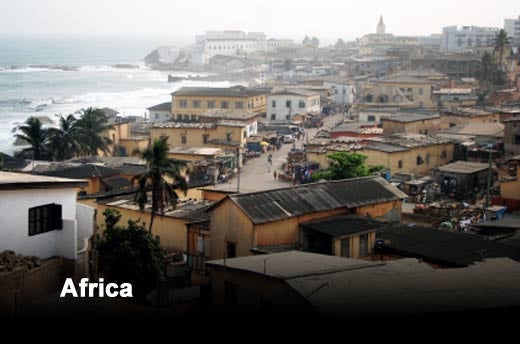

According to research from the Everest Group, market activity was higher in Q3 2011 with 46 new service delivery centers set up across both captives and service providers, as compared to 38 new delivery centers set up in Q2 2011. While Asia continued to account for more than half of location activity, there was significant activity in Eastern Europe. Africa, too, witnessed traction with five delivery centers set up in the location. Activity in Latin America marginally increased compared to the previous quarter although it was still lower than the quarterly average for 2010.

India dominated the landscape with 16 new delivery centers. Other leading countries that reported significant offshore activity were China and Ghana with six and three delivery centers, respectively.

Among emerging destinations, there were three delivery centers reported by leading buyers and service providers in Ghana. Despite political turmoil in recent months in Northern Africa, players have continued to demonstrate interest from sub-Saharan Africa.

Click through for the latest outsourcing trends identified by the Everest Group.

The Market Activity Heatmap classifies countries in terms of their maturity for supporting global services. Poland was elevated to the category of “mature location” during Q3 2011, an elite group previously consisting of India, the Philippines, China and Brazil. Market activity during Q3 2011 was high in India, China, Brazil and Romania

Asia accounted for almost half of the location activity during Q3 with 24 new centers reported from the region.

Within Asia, there was significant activity from China with 16 new centers.

Activity in Latin America was low with five reported centers during Q3. These centers were set up in Brazil, Colombia, Argentina and Costa Rica.

Overall location activity in Eastern Europe and Africa was significantly high during this quarter with 17 new delivery centers announced in the quarter. There was significant traction in multiple countries of Eastern Europe, particularly Romania.

Poland’s reclassification as a “mature location” during the previous quarter is a testimony to the maturity of the global services market in the country for BPO and IT services.

Location in Africa has also been significant with five new delivery centers set up in the region. Ghana witnessed activity from three leading service providers during the quarter.

Similar to the trends witnessed in Q2 2011, Q3 saw a higher share of Tier-1 cities as compared to Tier-2 cities.

The higher share of Tier-1 cities is largely attributed to activity from new service providers that prefer an established location for expanding their delivery footprint. Activity in Tier-2 cities is largely led by existing service providers that are more willing to explore Tier-2 cities given lower costs of delivery and access to a sizeable talent pool.

China’s “1000-100-10” project, initiated by the Ministry of Commerce (MOFCOM) in 2006, envisioned establishment of 10 cities as outsourcing bases attracting 100 international customers to set up operations in these cities and develop 1,000 service providers to meet demands of global companies. This project has provided significant thrust to the global services industry in China with interest from leading service providers and buyers.

Players are continuing to express interest in Vietnam, which is emerging as a low-cost alternative, leveraged selectively for small-to medium-scale IT/software delivery.

Everest Group’s analysis of cost arbitrage in leading offshore locations indicates that contrary to the perception, both India and the Philippines continue to have significant cost arbitrage with respect to source geographies.

On the other hand, currency appreciation in Brazil, Chile and Malaysia (against the U.S. dollar) is significantly eroding arbitrage potential in these locations.

Everest Group’s research also indicates opportunity for high-cost locations (e.g. Singapore, Australia and Canada) to compete in the higher order knowledge processing sector owing to availability of skilled talent pool and domain skills in these locations.