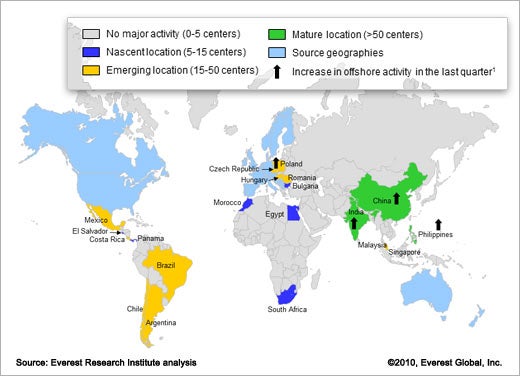

India has long been a dominant outsourcing destination and that hasn’t changed, based on recent research from the Everest Group, which tracks the relative maturity of different global services destinations. Latin America and Africa saw increases in outsourcing activity in 2010’s third quarter, while activity in Eastern Europe slowed.

Click through for further insights based on Everest’s heatmaps, which look at the number of captive delivery centers and third-party delivery centers established across the globe. The heatmaps are published in Everest’s quarterly Market Vista reports, which include additional data about outsourcing activity.

Click through for Q3-2010 outsourcing trends identified by the Everest Group.

The offshore services market continued to grow with 34 new offshore delivery centers established in Q3-2010.

Regulatory developments in the U.S. related to the Ohio government’s ban of offshoring state government contracts and increase in the visa charges for skilled workers are unlikely to have a significant impact in the short-term. However, these trends need to be carefully monitored to assess any long-term implications.

Asia continued to dominate delivery center activity with a 62 percent share of new delivery centers set up in Q3-2010. India dominated with 11 new delivery centers being set up during this quarter while significant activity was also reported from China and the Philippines.

The captive market in India has evolved with new captive setups which indicate a preference towards high value-add services like R&D/engineering services, besides IT and BP work.

Brazil experienced an increase in market activity in Q3-2010. Generally, the activity in Latin America is concentrated in locations like Brazil, Mexico, Argentina, and Chile. However, over the last 10 to 12 months, Central American countries such as Guatemala, Panama, Costa Rica, and El Salvador have established themselves as credible locations for providing bilingual voice support (English and Spanish) to the U.S.

Overall, momentum in Eastern Europe has slowed significantly in the last 12 to 15 months. The downturn in Continental Europe has dampened plans by companies and the currency and economic volatility in parts of Eastern Europe continue to impact investor confidence.

Poland, however, has witnessed more activity with two new delivery centers set up in Q3-2010.

In continuation with the previous quarters, Africa continued to witness an upswing in activity with a delivery center established in Morocco. In addition, a leading technology company also indicated plans to set up its captive in South Africa.

In contrast to Q3-2009, Q3-2010 saw a higher share of Tier-2 cities as compared to Tier-1 cities. We witnessed existing suppliers looking to expand their existing operations in established locations such as India and the Philippines. In these situations (i.e., captive and new geographies), companies tend to explore alternate delivery locations in Tier-2 cities to leverage lower costs in these locations and minimize concentration risk.