Based on recent research from the Everest Group, the offshore services market witnessed 38 new delivery centers set up across captives and service providers during Q2 2011. This is marginally higher than the 35 centers set up in Q1 2011, the first quarter of the year typically having less activity.

India dominated the landscape with nine new delivery centers. Other notable countries that saw activity were Ireland and Poland, with six and four delivery centers respectively.

Among emerging destinations, there were delivery centers reported by buyers and service providers in Nicaragua, Senegal, Tanzania, Mauritius, and Kenya. Despite political turmoil in recent months, activity was also reported from Egypt with a leading global service provider opening a new center in Cairo.

Click through for Q2 2011 outsourcing trends identified by the Everest Group.

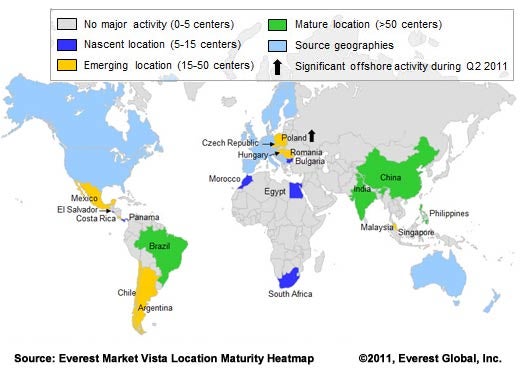

The Market Activity Heatmap classifies countries in terms of their maturity for supporting global services. Brazil was elevated to the category of “Mature location” during Q1 2011, an elite group previously consisting of India, the Philippines, and China. Market activity during Q2 2011 was high in India, Poland, and Ireland.

Asia accounted for almost half of the location activity during Q2 with 21 new centers reported from the region.

Within Asia, there was significant activity from the Philippines and Singapore with multiple service providers setting up delivery centers in the countries and also announcing plans to establish centers in successive quarters.

Activity in Latin America was significantly low with just two new centers reported during Q2. These centers were set up in Mexico and Nicaragua.

Brazil’s reclassification as a “mature location” during the previous quarter is a testimony to the maturity of the global services market in the country for IT services. In addition, service providers and captives also recognize an opportunity in leveraging Brazil for engineering services/ R&D.

Overall location activity in Europe and Africa was significantly high during this quarter with 17 new delivery centers announced in the quarter. There was significant traction in multiple countries of Europe, particularly Ireland, Poland, and Romania.

Despite the crisis in Middle East and North Africa, service providers continue to demonstrate their faith in Africa and reported six new delivery centers in the second quarter.

In contrast to Q1 2011, Q2 2011 saw a much higher share of Tier-1 cities as compared to Tier-2 cities.

The higher share of Tier-1 cities is largely attributed to activity from new service providers who prefer an established location for expanding their delivery footprint. Activity in Tier-2 cities is largely led by existing service providers that are more willing to explore Tier-2 cities given lower costs of delivery and access to a sizeable talent pool.

The rejection rates for the U.S. H1 and L1 visas (especially in case of service provider employees) have somewhat increased over the last 2 years, indicating a relatively stricter visa policy. This is believed to be triggered by reported misuse of temporary business visas by employees along with irregularities in application forms. Although there are some concerns among service providers, impact on onshore delivery is likely to remain limited as most of these providers have built a meaningful onshore delivery team. In addition, providers have also taken initiatives related to better demand forecast and hiring plans and begun to exercise greater caution while applying for the U.S. visas and impose stricter checks to avoid misuse.

Everest had commented about the political crisis unfolding in the Middle East and Africa during the beginning of the year. In the immediate aftermath of these events, business operations were impacted in these countries with many service providers relocating staff for their safety and security. However, these events had only impacted investors’ short-term and immediate perspective towards Africa. Over the medium-to-long term, both buyers and service providers continue to remain optimistic about growth prospects in Africa. This optimism and interest is due to the value proposition of many African locations for global services. These include

- Gateway to domestic and African markets (e.g., South Africa for sub-Saharan regions, Egypt for North African markets)

- Low-cost alternative to Eastern European locations

- Scalable language skills and cultural affinity with developed world (e.g., South Africa has strong cultural affinity with the UK)

There have been several instances of terrorist threats/attacks on key cities in India, in the past few years. The most recent attack was a series of bomb blasts in Mumbai during July 2011 that killed 23 and injured 160 persons. While none of the attacks were targeted at offices or businesses, companies have started taking measures such as increasing security of their premises and also training employees on evacuation drills. These attacks are not likely to impact global services delivery from India (given the location’s distinctive value proposition around low cost, quality of talent pool, and investor-friendly business policies), these events highlight the need for companies to have a robust disaster recovery plan.