Cyber criminals and scammers view tax season as a prime opportunity. There are many ways that you can fall victim to their attacks and scams. The IRS has issued numerous consumer warnings about the fraudulent use of the IRS name or logo by scammers that are trying to trick consumers into providing their personal information (identity theft) in order to steal their financial assets or commit fraud. In addition, tax preparers and tax software vendors are often impersonated. Scammers use email, the web, postal mail, telephone and fax to set up their victims.

In this slideshow, Marie White, CEO of Security Mentor, a security awareness provider, discusses some of the serious tax scams and tax fraud, and offer ways to help you avoid them.

Avoiding Common Tax Scams

Click through for common tax scams and suggestions for how to avoid them, as identified by Marie White, CEO of Security Mentor.

Phishing

Fake emails pretend to be from a trusted authority like the Internal Revenue Service (IRS), tax software vendor (e.g., TurboTax), or a tax preparer (e.g., H&R Block). Links in the emails direct you to a website that directs you to enter sensitive personal information such as bank account information or Social Security numbers. Once entered, the data is stolen and used for identify theft or tax fraud.

Don’t click on links in emails. Instead, go directly to the site by typing in the URL or entering it in a search engine. Note that the IRS does not initiate taxpayer communications by email or other messaging services. Unsolicited email claiming to be from the IRS, or from an IRS-related component such as Electronic Federal Tax Payment System (EFTPS), should be reported to the IRS at phishing@irs.gov. Also, be careful of the sites you visit. Malicious sites can look authentic. Look carefully at the web address, or URL, and confirm that there are no typos or misspellings.

Malware

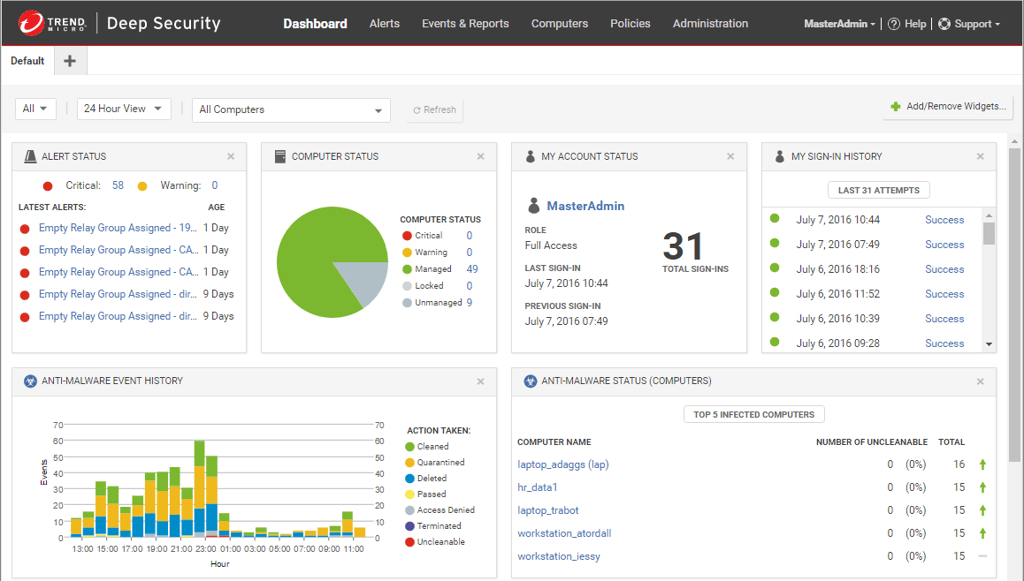

Cyber criminals send emails appearing to come from the IRS or a tax preparer that contain a malicious attachment. If you open the attachment, malware will be installed on your computer. In addition, websites you visit can even download malware automatically; this is called drive-by malware. The best way to protect yourself is to not open attachments from unexpected emails and to run anti-malware software.

Tax Refund Theft

Another type of tax fraud that is rampant is tax refund theft. Scammers apply for an Electronic Filing Identification Number (EFIN) then, together with stolen Social Security numbers, apply for income tax refunds in other people’s names. The GAO estimated that the IRS paid out $5.8 billion in fraudulent refunds related to identity theft in 2013. To guard yourself, protect your Social Security number. Never provide your Social Security number unless it is to a trusted authority, and don’t submit it online unless it is over SSL (HTTPS). Some also advise that you should file your tax return early in the tax season before identity thieves have the opportunity to do so.

Infected or Insecure Computers

If the computer you are using has malware or spyware installed on it, any information that you enter could be captured by keylogging software. If preparing your own tax return, always use a computer that is running up-to-date anti-malware, and has a firewall. Another risk is that when your computer is running file-sharing software, information can be accidentally exposed. For example, if teenagers use the same computer on which the tax preparation is done and have downloaded peer-to-peer software, make sure the settings on the application do not allow for access to areas on the computer where sensitive data, like tax information, is stored. Better yet, don’t use a computer that has peer-to-peer software on it.

Once you’ve filed your tax forms, take precautions to prevent them from being stolen. Protect the data stored on your hard drive by either encrypting it or copying it to storage media (e.g., CD, USB drive) and then deleting it from the computer. The storage media should be stored in a secure location or encrypted itself. Lock all paper copies in a secure location like a filing cabinet. Before disposal, shred any documents that contain sensitive personal information.