When it comes to battling fraud, two basic issues cause problems for just about every company: They don’t have the data they need to immediately identify a fraudulent transaction, and the cost of deploying dedicated systems to identify fraud outweighs any of the potential savings.

As a result, many businesses simply chalk up fraud to being one of the costs of doing business. What’s not fully appreciated is that when all that fraud is added up, it amounts to billions of dollars, and that winds up sapping the global economy.

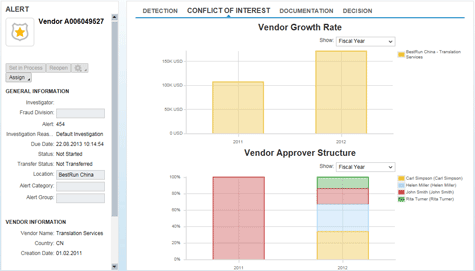

To combat fraud more efficiently, at the Strata Conference + Hadoop World 2013 event today, SAP announced the general availability of SAP Fraud Management, an analytics application that runs on top of the SAP HANA in-memory computing platform.

According to David Parker, vice president for Big Data for SAP, this approach solves some critical challenges when it comes to eliminating fraud. As an in-memory computing platform, HANA allows transactional and analytic applications to run side by side on the same platform. This makes it a lot easier to correlate customer information with pending transactions in real time to identify possible fraudulent transactions. And because SAP Fraud Management is an application, Parker says it’s a lot more cost effective than building a custom fraud management system from the ground up.

In keeping with that theme, Parker notes that as SAP continues to make its entire portfolio of applications available as a cloud service, it’s only a matter of time before SAP Fraud Management shows up in the cloud.

Fraud is one of those criminal activities that most people rarely experience first-hand, but the cost of fraud inevitably gets passed on to consumers when companies factor it into the cost of doing business. As Big Data evolves, one of the surest places for applying this technology in a way that generates a positive return on investment is to prevent fraudulent transactions.