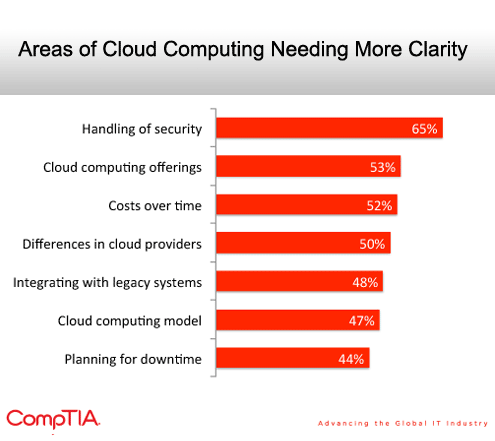

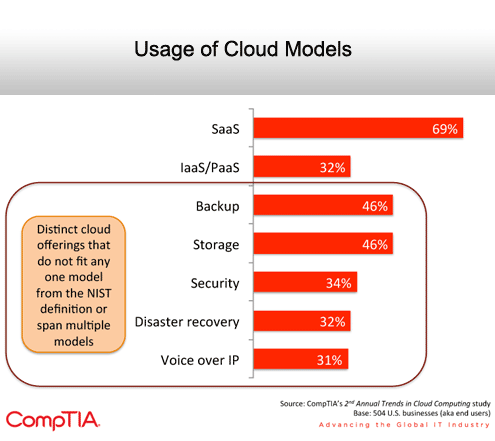

The bad news is that there is still plenty of confusion over what services are being offered in the cloud and concerns over security issues are still holding some people back. In addition, the depth of knowledge about the cloud may be questionable given how much the respondents seem to equate software-as-a-service (SaaS) applications with cloud computing. There’s no doubt that SaaS represents a major part of the cloud computing marketplace, but it’s certainly not the most compelling element.

Seth Robinson, director of technology analysis for the trade association, says that as investments in the cloud increase there is no doubt that IT organizations will also gain a greater understanding of both infrastructure-as-a-service (IaaS) offerings and platform-as-a-service (PaaS) offerings. Whether those two categories remain distinct is still unknown, but Robinson says he expects that PaaS adoption will probably advance at a much slower rate than IaaS.

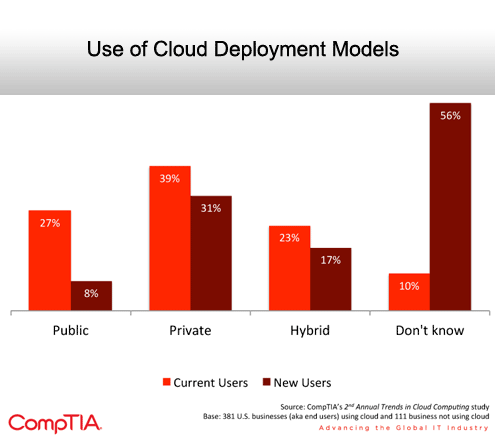

The survey also seems to indicate that there is a significant amount of rising interest in private clouds. But it’s still not all that clear whether those private clouds will be deployed on premise or on public infrastructure or in some hybrid fashion that spans both approaches.

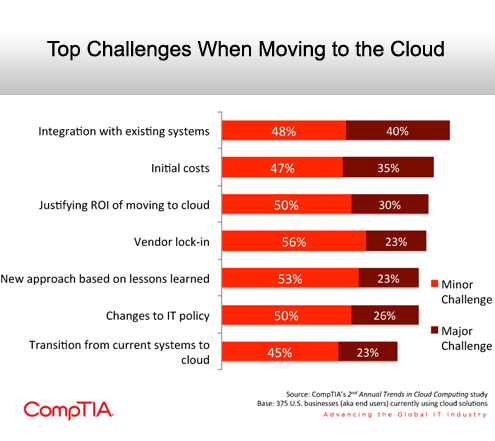

What is clear is that integration costs, coupled with the initial cost of setting up a cloud environment, are starting to become much bigger concerns as IT organizations move from thinking about the cloud to actually trying to build and manage one.

Click through for results from a cloud computing study from CompTIA.

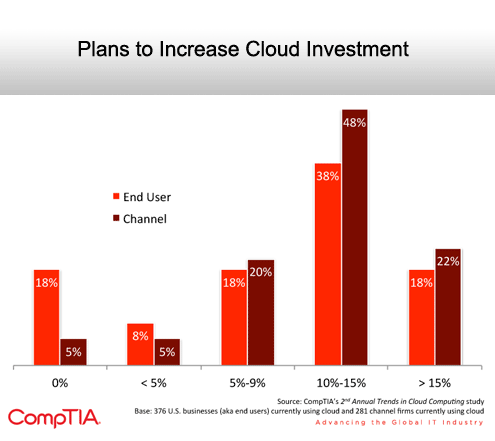

Growth will be in the double-digit range for most.

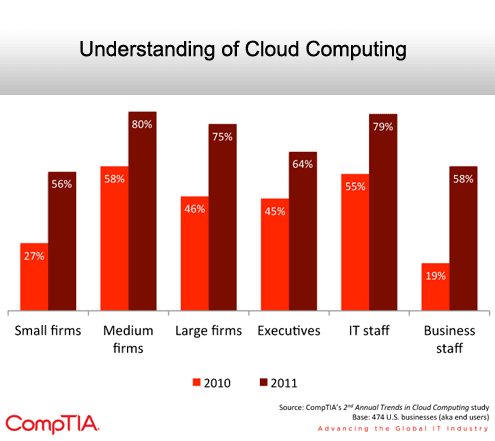

Significant improvement across the board.

Security still tops the list.

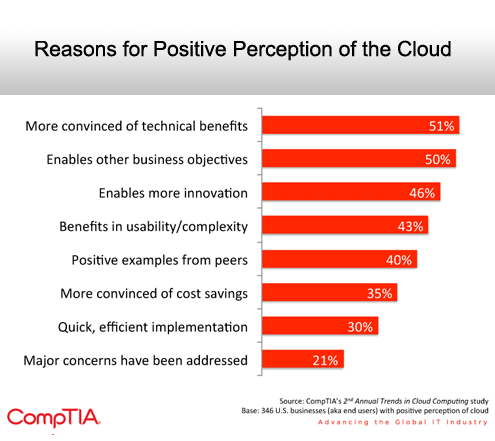

Benefits of the cloud are better understood.

SaaS still dominates.

Still a lot of uncertainty, but private on the rise.

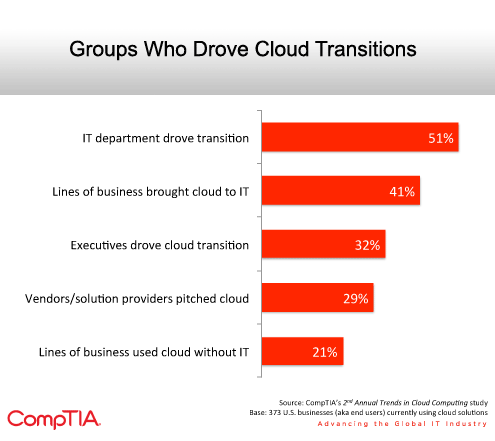

IT groups are the biggest drivers.

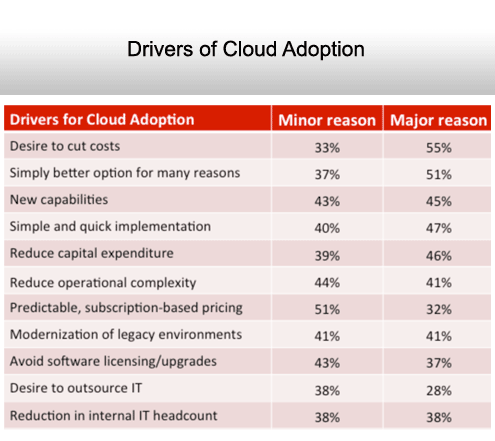

Cutting costs still narrowly leads.

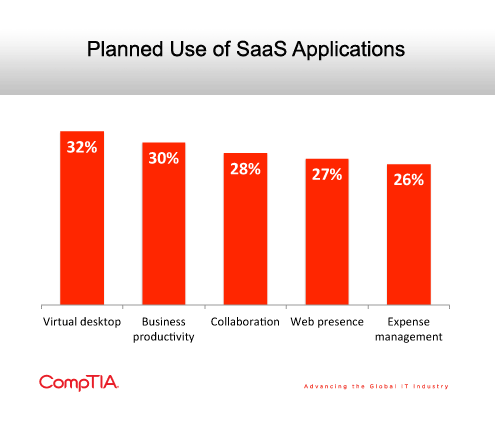

Virtual desktop is surprisingly strong.

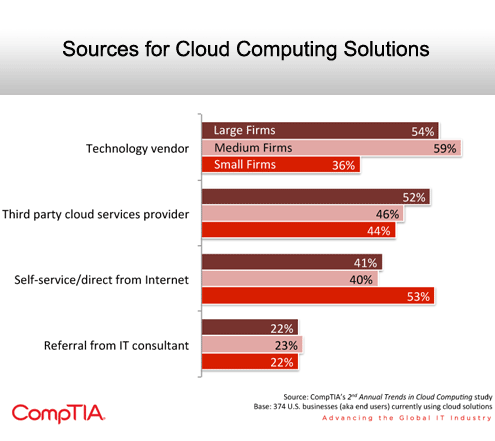

A battle for control.

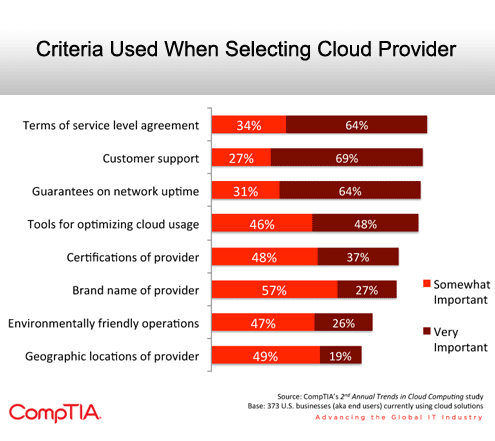

Service quality is everything in one form or another.

Integration tops a long list.

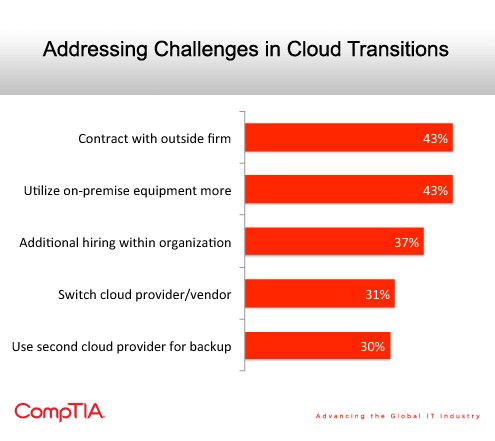

Leveraging existing equipment is a priority.