The finance department isn’t always regarded as being at the forefront of digital business transformation. But as artificial intelligence (AI) technologies continue to mature, one of the biggest drivers of AI adoption when it comes to accounting will be the fiduciary responsibilities of the chief financial officer (CFO).

Accountants spend a lot of time laboriously matching invoices with other various statements of work to determine whether a payment should be made in, for example, 30, 60 or 90 days. Given the fact that these activities are largely an exercise in pattern recognition, it’s only a matter of time before tasks such as these are more efficiently accomplished by machine learning algorithms capable of visually inspecting documents and determining what actions need to be taken based on rules defined by the CFO.

In fact, SAP is already predicting that the days when organizations hire large numbers of accountants just to process documents are near an end.

“Machines will soon handle most routine accounting processes,” says Christian Pedersen, chief product officer for SAP S/4 HANA Cloud.

AI Transforming Accounting Processes

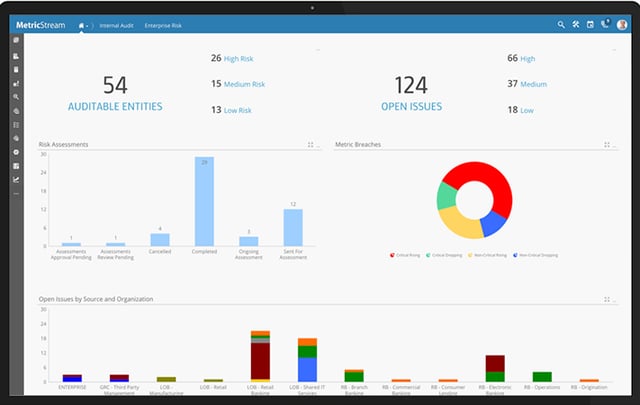

Examples of accounting processes that can be automated using machines include everything from processing expense reports to accounts payable. Even risk assessments will be made by machines taking advantage of advanced analytics to assign risk scores.

There are already instances where machine learning algorithms have been inserted into accounting applications to automate a task. Most of those uses cases are still rudimentary at best. But this is only the beginning. AI applications will soon be able to predict not only when an organization will exceed or miss financial targets based on sales data analyzed in real time but gauge the accuracy of sales projections based on projections individual sales representatives have historically made, says Elliott Yama, chief data analyst for APTTUS, a provider of an order-to-cash application infused with AI.

That’s a critical requirement because it’s not uncommon for salespeople to be either overly optimistic or simply make promises they can’t possibly deliver. In other cases, salespeople try to minimize their quota requirements by under promising what they know can be delivered as part of a process known as “sandbagging.” AI applications will be able to spot those instances in a way that will enable the finance department to generate more accurate forecasts.

Because every member of the senior leadership team is held accountable for the accuracy of those forecasts, being aware that a forecast is not going to be met gives the organization precious time required to potentially reverse that outcome by, for example, deciding to make additional sales incentives available. Alternatively, the AI application could reduce cost by automatically reducing the amount of materials being ordered via integration with a digital supply chain system.

“Ultimately, it’s the job of the CFO to create value,” says Yama. “AI enables them to do more with less.”

New ERP Applications, New Reliance on Quality Data

Creating those kinds of systems will require deploying new classes of ERP applications capable of learning. In fact, Yama notes that before too long, competition among rival vendors will occur between rival AI models that are constantly being tuned as algorithms absorb more data. Those AI models will naturally span everything from accounting to supply chains and customer service. But it may very well turn out to be CFOs that drive the initial adoption of those AI models as part of a digital business transformation that begins in the finance office.

None of this necessarily means accountants will be put out of work. But it does mean the role of accounting professionals will need to be redefined. The days when accountants spend most of their time manually matching documents will soon be over. In its place, many accountants will have a new speech-enabled digital assistant that not only handles all their tedious tasks, but also makes “helpful” suggestions concerning where the latest accounting discrepancy might lie hidden.

In fact, a survey of 3,000 accountants conducted by Viga on behalf of Sage, a provider of accounting software, finds two-thirds of accountants expect AI and other forms of automation to help reduce repetitive tasks in a way that frees their time to provide valued consulting and advice to their clients. Specifically, the survey finds almost half (49 percent) would like to automate number crunching, data entry, email and diary management, and 66 percent say they would invest in AI if it automated repetitive and time-consuming tasks. Clearly, accountants for now at least don’t view AI as an existential threat to their existence. In fact, 55 percent of accountants said the plan to employ AI to run their business better.

AI, of course, won’t just be limited to internal accounting. Chances are high that audits will soon be largely conducted by machines as well. Accounting professionals may soon find their every move being scrutinized by machines capable of discovering the relationships between thousands of electronic and paper documents in a matter of minutes.

The ultimate impact that AI will have on accountants is still unclear. The chair and the president and CEO of the American Institute of Certified Public Accountants (AICPA), last year did warn members of the association that up to a million accounting jobs could be lost because of advances in IT. For now, however, it would appear most accounting professionals are more focused on the benefits that AI will bring to them personally versus the potential impact it might have on demand for their services.

Of course, the single biggest impediment to implementing AI is a lack of quality data. Machine learning algorithms require access to lots of data to improve their accuracy. Right now, only large organizations tend to have the discipline required to enforce the high levels of data quality required for AI models to effectively learn how to automate a process.

There’s no doubt accounting at this juncture is about to be transformed utterly. Most CFOs will be eager to at the very least experiment with AI in the months ahead. It may be years before they fully trust AI systems. But once an AI system learns something, it never forgets it. Nor does it take sick days, quit to take another job, or make errors because personal issues are getting in the way of the task at hand. For CFOs tasked with maximizing the value of investments, those benefits alone will make AI too hard to ignore.