Many IT organizations are aware of the fact that in terms of the applications their end users actually use, the return on investment in Microsoft Office has always been a relatively expensive proposition. Now SoftWatch Technologies is making available the tools to prove it.

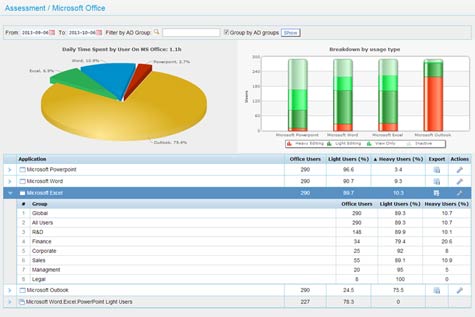

SoftWatch today launched a namesake analytics application that keeps track of usage patterns of Microsoft Office across the enterprise, which a new report from SoftWatch suggests is not anywhere near as much as Microsoft would like. Based on a study of 150,000 users of Microsoft Office, SoftWatch reports that the average employee only spends 48 minutes a day on MS Office applications, most of it on Outlook for email. The study also finds high numbers of inactive users in the organizations; in particular, PowerPoint was not being used at all by half of the employees.

But perhaps most importantly, the study also confirms what many in IT already intuitively know. Most Microsoft Office applications are used primarily for viewing and light editing purposes, with only a small number of heavy users. Specifically, the report finds that only 2 percent of PowerPoint users, 9 percent of Word users and 19 percent of Excel users frequently use those applications. The simple truth is that most users of productivity applications only wind up viewing the data versus actually editing it.

In support of its software-as-a-service (SaaS) application, SoftWatch co-CEO Uri Arad says the report makes a strong case for giving users that infrequently access Microsoft Office applications a lower-cost alternative. While once upon a time there was no real alternative to Microsoft Office, with the rise of productivity applications in the cloud such as Google Apps, Arad says there is clearly a lower-cost alternative that makes more sense for a larger percentage of end users than Microsoft Office. Arad says that Microsoft Office is not the only enterprise application where there is a wide divide between what organizations pay to license versus what they actually use, so it won’t be too long before SoftWatch turns its analytics attention elsewhere.

Of course, there are plenty of other low-cost alternatives to both Microsoft Office and Google Apps in both the cloud and on mobile computing devices. The real issue is that the distribution of Microsoft Office across the enterprise continues to be pretty much taken as a given. But upon closer examination of how the applications are actually being used, it becomes clear that 80 percent of the users are not getting as much value out of them as the other 20 percent. As such, the time may be at hand to start moving some segment of the user population to other applications that better fit their usage profile.