In early 2013, IFS North America and Advantage Business Media conducted a study among executives with industrial companies to determine how respondents involved with enterprise resource planning (ERP) and other enterprise software perceived various methods of software provisioning, including on-premise, hosted, software as a service (SaaS) and private cloud.

Historically, ERP and other enterprise software was housed on servers on the premises of a business. The increasing availability of high bandwidth LAN, WAN, dark fiber and public Internet connections, however, has broken down the geographic barriers that made the on-premise delivery model the only option.

Another technological change that is affecting how enterprise software is provisioned is the availability of clustered server technology delivering variable capacity that can be sold on a pay-as-you-go basis.

Prior to this, servers ran applications in a linear design without extensive redundancy or scalability. Scalable and easily partitioned server technology is available now that can allow organizations with centralized computing resources to sell computing resources over the public Internet as a service. The infrastructure itself can be purchased as infrastructure as a service (IaaS), or it can be paired with an operating environment or other facilitating technologies as platform as a service (PaaS). Either way, an end user can be relieved from responsibility to purchase and maintain hardware.

Click through for results from a study looking at how individuals involved with enterprise resource planning (ERP) and other enterprise software perceived various methods of software provisioning, conducted by IFS North America.

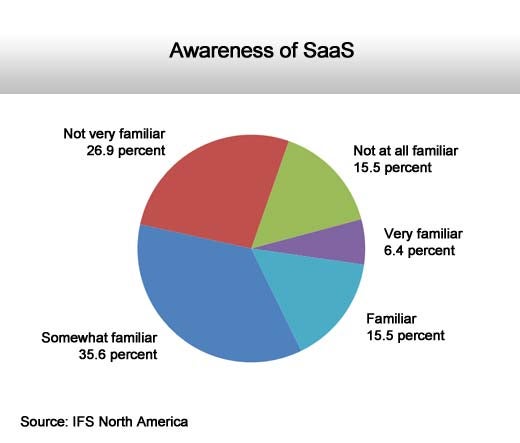

When the software running on the platform is also sold as a service, the result is naturally referred to as software as a service (SaaS). In this study, IFS North America measured the level of usage, awareness of and preference for SaaS versus on-premise and other cloud-based delivery models when it comes to delivering mission-critical applications like ERP.

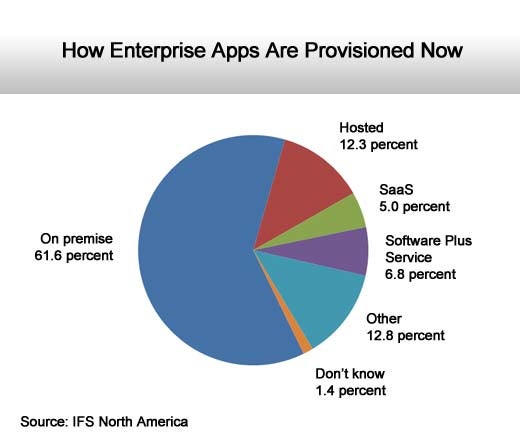

Usage of SaaS ERP is low in this sector, between five percent and 20 percent.

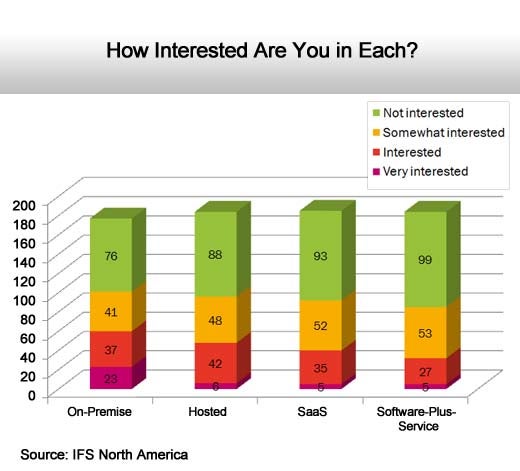

Interest in SaaS is lower than for on-premise and traditional hosting.

The vast majority of respondents have some level of familiarity with SaaS.

Respondents were asked open-ended questions about what they saw as the advantages and disadvantages of SaaS.

- Cost topped the list of advantages, with a minority of respondents specifying that capital cost would be lower.

- Cost was also mentioned frequently by respondents as a disadvantage of SaaS. While it is true that initial cost for an SaaS project is typically lower, the software license is only being rented and therefore it becomes more rather than less expensive after a period of years.

- Automated and centralized upgrades were also seen as an advantage for SaaS.

- Security and control tied among the most frequently-cited disadvantages. Cost was also a frequently-used term in these responses, as was ownership. The lack of ownership of the software contributes directly to the cost, so these issues may be seen as interdependent.

CRM is the application most frequently purchased through SaaS currently. And judging from the number of respondents saying they may buy SaaS CRM in the future, CRM represents perhaps the most significant growth area for SaaS vendors.

While private cloud has not received the coverage in the IT and business media that SaaS has, respondents were slightly more interested in private cloud than they were in SaaS.

- Gartner defines Private Cloud as: “A form of cloud computing where service access is limited or the customer has some control/ownership of the service implementation.”

- Private cloud is not a term used as ubiquitously as SaaS, but there is some degree of familiarity in the market.

- Interest in private cloud as a provisioning method for enterprise software on the whole seems somewhat higher (64.4 percent) than interest in SaaS (39.7 percent).

SaaS can be an attractive ERP provisioning system in some cases:

- For very small companies that have no internal infrastructure or IT capacity to support the software.

- For point solutions that are not mission critical.

- For businesses that in effect want to circumvent capital budgets and their IT department to implement enterprise software with less red tape.

SaaS is also an extremely attractive business model for some software vendors.

- Revenue for SaaS software companies tends to be much less volatile.

- Multipliers used in mergers and acquisitions for SaaS-only software companies tend to be very high due to the recurrent revenue that comes with the pay-as-you-go model.

For broader enterprise software implementations like ERP, IFS believes in the perpetual license model rather than the subscription model.

- Lower total cost to the customer over the typical 10-year-plus lifecycle for enterprise software.

- Many IFS customers are in aerospace and defense and in other industries where operating on a shared version of software would be problematic.